This article originally appeared in Stockhead.

- Office valuations have crumbled, but experts say REITs are more than just office properties

- Analysts say healthcare REITs can better withstand economic scenarios

- Stockhead reached out to RAM’s head of Real Estate, Matthew Strotton

The office property crisis has put the REIT (real estate investment trust) sector in a difficult spot as investors become increasingly spooked by the global downturn in commercial property values.

In the US, office property values have plunged by over 35% from their pre-pandemic peak, the worst decline since the global crisis of 2008/2009 as the market adjusts to higher interest rates and the new world of remote working.

But while office valuations have slumped, some analysts are quick to point out that the REIT sector isn’t just about office blocks.

There are other funds out there like ASX-listed RAM Essential Services Property Fund (ASX:REP), which invest in the growing sector of healthcare.

“We don’t want to be tarnished with the same brush [as office blocks],” said Matthew Strotton, the head of Real Estate at RAM, the company that runs the REIT.

Strotton believes the healthcare property sector can withstand economic scenarios far more ably than office real estate, but says the market hasn’t caught up to this fact.

“The market is interpreting the health of the real estate index by what they’re reading about the office sector, and if I’d read that, I would indeed be reading about pure disruption,” he told Stockhead.

According to Strotton, the healthcare market has far more tailwinds behind it – the number one factor being our ageing demographics and unprecedented government funding.

“We have a strong population growth, and like most developed countries around the world, we have an ageing population.

“There is an underlying state, local and federal support to ensure healthcare services are maintained at all levels of our community.”

“We could arguably say that across the country, there is continued burden on our healthcare system, which leads to the conclusion that we are under supplied,” explained Strotton.

What the REP REIT invests in

The REP fund currently owns 35 assets split roughly 50/50 between healthcare and convenience malls/supermarkets.

Healthcare assets include hospitals, physiotherapists, dentists, pharmacies, GP clinics and private surgeries – with tenants such as St John of God Clinic, Life Fertility, and private hospital operator, Healthe Care.

Retail tenants meanwhile include names such as Woolworths, Coles and Wesfarmers.

Like healthcare, Strotton says the food retailing category produces consistently, and is one he believes could withstand economic shocks.

“We have 301 tenants across our portfolio and only less than a handful are under any sort of duress. No one’s locking doors, no one’s closing up shops.

“Of our eight supermarkets, seven of them are significantly above state and national averages in terms of turnover,” he said.

In healthcare, RAM expects to add up to $1 billion in assets over the next 12 months as the fund aims to bolster its exposure to the sector.

The fund has recently acquired a private hospital on the Sunshine Coast and a medical centre in Perth as part of its redevelopment investments.

“These are distinct from the type of assets that the REP fund currently has, these are higher risk redevelopment assets,” said Strotton.

“Although we don’t really set a longer term objective on our asset split, I would say tactically that a tilt towards healthcare is most certainly on the cards.”

Is the REP fund undervalued?

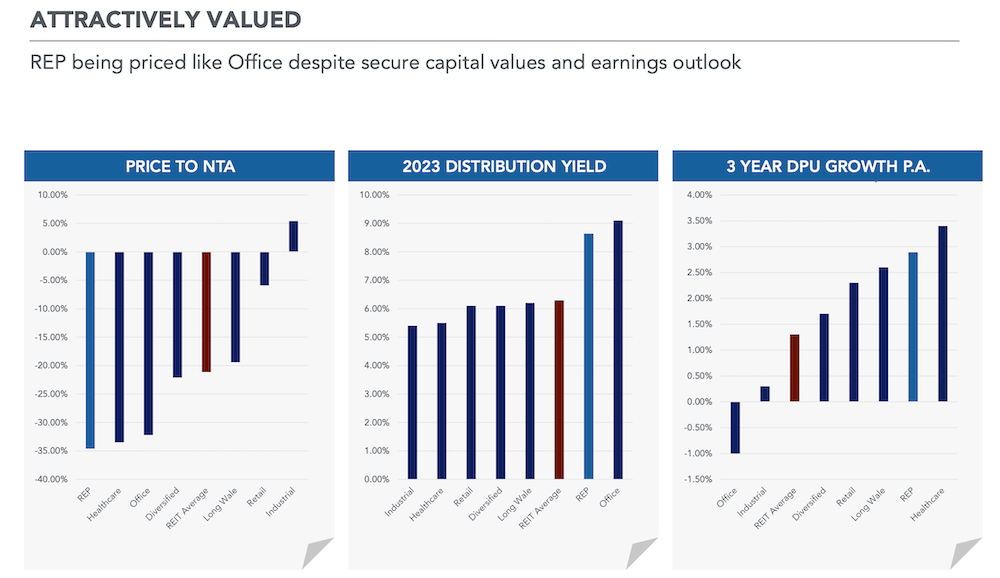

RAM believes the market is mis-pricing its REP fund, which it says could be trading at a steep 30% discount to the value of underlying assets.

This, Strotton says, appears to be caused by an unjustified disconnect between listed and unlisted healthcare asset values.

He explained that the total valuation of the fund’s underlying assets – as undertaken by third party appraisals at arm’s length – currently stands at around $800m, or $1.03 per share.

In addition to that, there are four impartial analysts that review the portfolio on a regular basis – Ord Minnett, UBS, Credit Suisse and E&P – and the average target price they’ve put on the share price is 96 cents.

“But we’re currently trading at only 70 cents a share, so on my calculation we’re about 30% undervalued, give or take,” Strotton said.

Strotton added that listed real estate markets tend to be priced top down, and as we’ve seen on cycles prior to this, investors often overshoot the mark.

“That’s human behaviour, so the only way to really prove underlying real estate valuations is to actually transact real estate.

“If we can transact our assets at or above our book value, that’s one way we can prove to our investors that our unit price is undervalued,” Ward said.

Strotton says he’s currently talking to prospective buyers on up to nine assets ranging from $8m-$80m across healthcare and retail in order to initiate these transactions.

In terms of the macro picture, he believes that in order for the commercial property market to rebound, what needs to happen first is for people to have visibility around interest rates and, ironically, a weaker economic outlook.

“If we encountered a severe downturn or a recession, the two sectors in real estate that would withstand those scenarios better than any of the others would be healthcare, and the supermarkets and essential services,” said Strotton.